Thank You!

Thank you for reaching out! Our Intake Manager will contact you shortly to schedule a consultation. We look forward to assisting you.

Additional Resources

Once appointed, a conservator has significant responsibilities, including: Managing Assets: Setting up a conservatorship bank account, paying bills, and managing investments. Filing Court Reports: Filing an initial inventory of the conservatee's property and a plan for managing assets within two months of appointment. After that, annual returns must be filed, updating the inventory and asset management plan. Acting in the Conservatee's Best Interest: Always prioritizing the conservatee's needs and well-being, avoiding conflicts of interest, and maintaining accurate financial records. Seeking Court Approval for Major Decisions: Obtaining court orders for actions not specifically authorized by the initial conservatorship order, such as selling property or encroaching on the principal of the conservatee's estate.

What Happens to Bank Accounts When Someone Dies? When someone dies, their bank accounts can go to beneficiaries, joint account holders, or become part of their estate, depending on the account type and how it was set up. · If a beneficiary is named (e.g., on a payable-on-death, or POD, account), the money goes directly to them after the bank receives a death certificate. · If there's no beneficiary, the account typically becomes part of the deceased's estate and is subject to probate, where a will (if there is one) dictates distribution or, if there is no will, state law determines how it's divided. Here's a more detailed breakdown: 1. Joint Accounts: If the account has a joint owner, the surviving owner usually retains ownership of the funds. 2. Accounts with Beneficiaries: When a beneficiary is named (e.g., on a POD account or for retirement accounts), they can claim the funds by providing the bank with a death certificate and other required documentation. 3. Accounts without Beneficiaries : If there's no joint owner or beneficiary, the account becomes part of the deceased's estate. 4. Probate: The deceased's will, if one exists, will guide how the estate (including bank accounts) is distributed. If there is no will, state laws of intestacy will determine how the estate is divided, usually among surviving spouse and children. 5. Probate involves gathering assets, paying debts and taxes, and distributing the remaining assets to the appropriate beneficiaries or heirs. 6. 5. Important Notes: Banks may freeze accounts upon notification of death to verify the proper transfer of funds. The time it takes to resolve the transfer of funds can vary, especially if probate is involved. Having a will and naming beneficiaries can simplify the process for loved ones after death. Give Meyerson Law a call for more information 678-892-5910

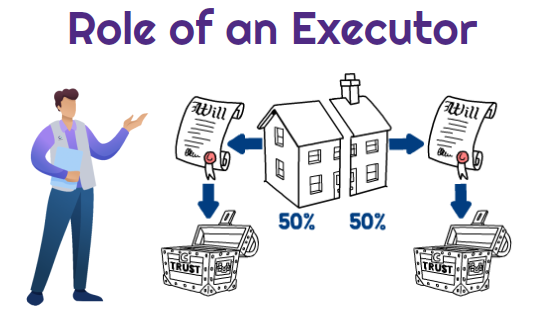

Who should be your Executor? Choosing the right executor for your estate is a very important decision. Your chosen executor is responsible for managing your estate, paying off your debts, and distributing your assets to your beneficiaries. It is essential to choose someone who is reliable, trustworthy, available and capable of and willing to handle the responsibilities. Below are a few tips to help you select the correct executor for your estate. 1. Consider the Executor's Qualifications The person you choose as your executor should be trustworthy, dependable, responsible, and organized. He/she should have at least some knowledge of financial matters and legal procedures. If you have a complex estate, you may want to consider hiring a professional such as an attorney or a financial advisor. 2. Choose Someone Who is Willing to Serve Your executor should be willing to serve in this role. It is not uncommon for people to decline the offer to be an executor due to the time and effort involved. Therefore, it is essential to select someone who is willing to take on this responsibility and has the time and availability to fulfill the duties. 3. Consider the Executor's Relationship to You Your executor should be someone who has a close relationship to you and your beneficiaries. He/she will be responsible for making decisions that impact your beneficiaries' lives. If you choose an executor with no connection to your beneficiaries, he/she may not have their best interests in mind. 4. Review the Executor's Availability and Location Your executor should be available and accessible. If your executor lives far away or keeps a busy schedule, they may not be able to fulfill their duties in a timely manner. Therefore, it is essential to choose someone who is local and has the ability to manage your estate. Choosing the right executor for your estate is a crucial decision. which requires careful consideration. Make sure to choose someone who is trustworthy, responsible, and capable of fulfilling the duties. Consider their qualifications, willingness to serve, relationship to you and your beneficiaries, as well as their availability and location. If you need help choosing an executor or managing your estate, contact Meyerson Law Firm. Attorney Seth Meyerson and team have the skills and experience to help you make informed decisions about your estate.